Deloitte’s Global Chief Procurement Officer Survey 2021 in Pictures

The annual Deloitte’s Global Chief Procurement Officer Survey is out, which also marks the 10th anniversary of this report series. The theme for this year is “Agility: The antidote to complexity”.

Understanding this is a comprehensive report which collects data from CPOs around the world, we thought a visual digest of the highlights would help.

You can always refer to the full report here.

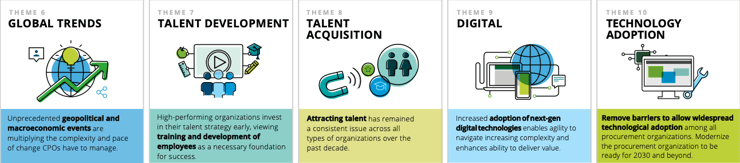

As a side note, it’s an interesting journey for procurement pros over the last decade if you look at the themes of this report series. Whilst these are depicted as evolving trends, you can still see some of the “older” ones recurring now.

Let’s get into the highlights of the 2021 report.

Priorities have shifted

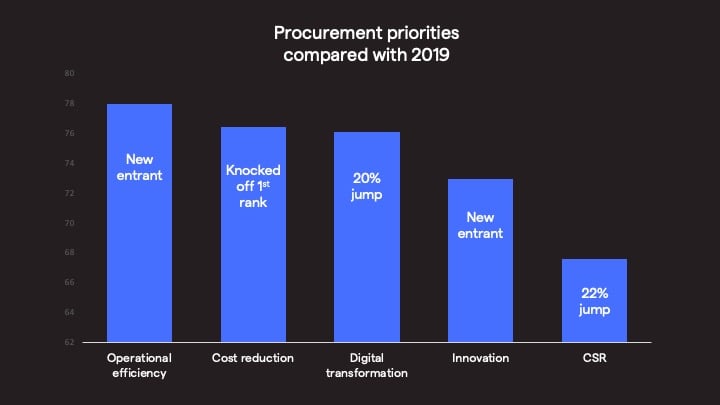

In comparing CPO’s priorities between this year and 2019, Deloitte noted the first-ever presence of “driving operational efficiency”, trumping the age-old “Reducing costs”.

Also:

How high performing CPOs compare with others

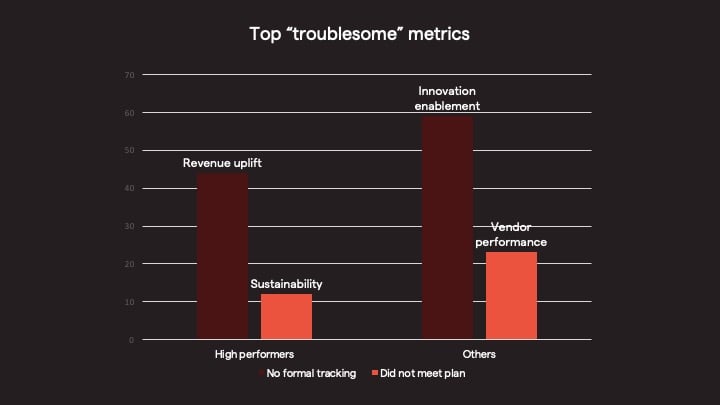

Over the last 12 months, high performers generally performed better on more sets of KPIs. Here, we’re just interested in the metrics that the 2 groups had the most issues with, either having no formal tracking or failing to meet the target.

Has procurement got a seat at the table?

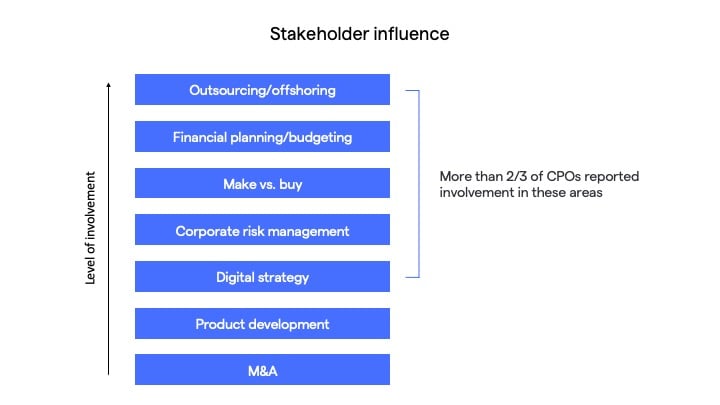

Procurement’s extent and quality of influence over stakeholder decision making would give a good indication.

Interestingly, Deloitte also noted that the executive team is mostly supportive of procurement, but “the trick is in understanding how to leverage this to increase the quality of influence across the organisation.”

Risky business

The pandemic has left lingering effects throughout the world, resulting in supply assurance being the biggest challenges for CPOs over the last 12 months.

That means to achieve agility, CPOs need to improve on these current metrics. At the moment, while the majority claim to have good visibility on the risks existing within tier 1 suppliers, the reverse is true for tier 2 and beyond.

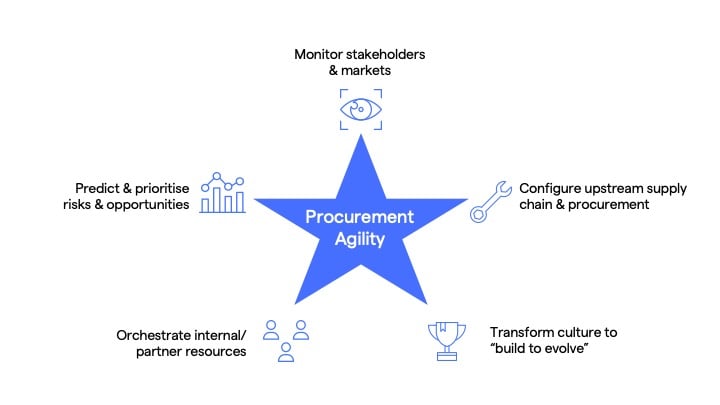

But what exactly is agility?

Here's a neat summary:

Deloitte stressed that to up the agility game, procurement teams need to be “customer-centric”, which links back to the stakeholder influence metric mentioned above.

These include stakeholders in the supply chain (i.e. extended enterprise) too, since procurement acts as “the bridge between functions and supply networks”.

Supplier collaboration therefore rose in prominence, and includes many areas already ripe for digital transformation: supplier information management, supplier performance management, supplier risk and compliance management, supplier innovation, and supplier relationship management (SRM).

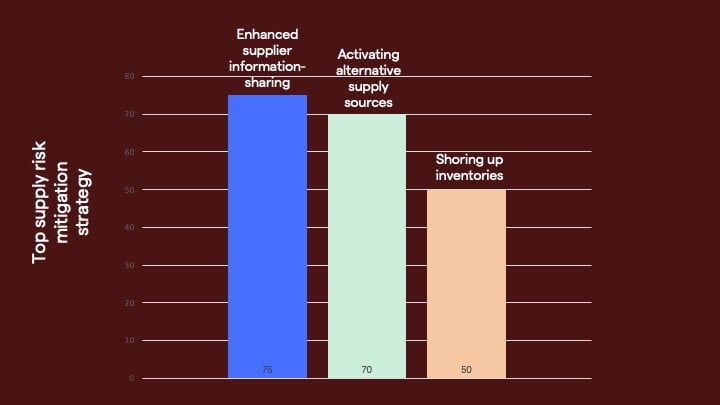

Top supply risk mitigation strategy

Recognising information sharing as the top strategy, CPOs also need to find a way to collaborate with their vendors at scale, which means a combination of digital tools and a robust supplier segmentation strategy.

Building agile procurement teams

To build agility into procurement, it’s not just about “periodic simplification/ standardisation of processes, policies, and systems”.

COVID-19 has forced many businesses into a virtual operation overnight, with ways of working, mindsets, skillsets having to evolve from that point.

CPOs are still investing quite heavily in technical skills, and less so in soft skills despite the acknowledge gap.

The road to digital

The top performing “agility masters” are indeed more likely to adopt “next-gen” technology such as RPA, advanced analytics/visualisation and AI. But generally:

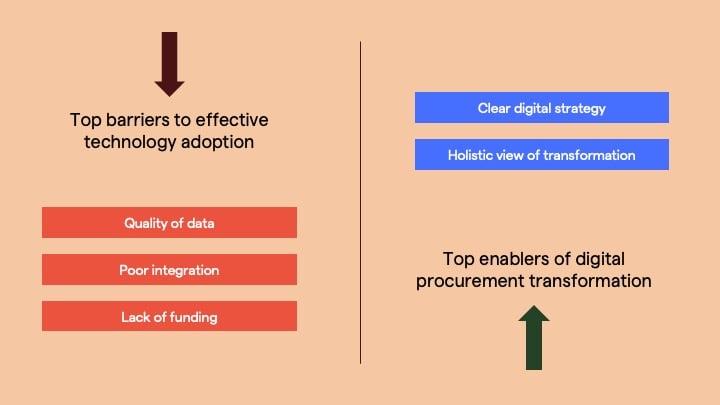

The road towards digital procurement transformation is not paved with roses, however.

We also discussed the barriers based on the 2019 report here. It seems the ranking of these issues has remained unchanged.

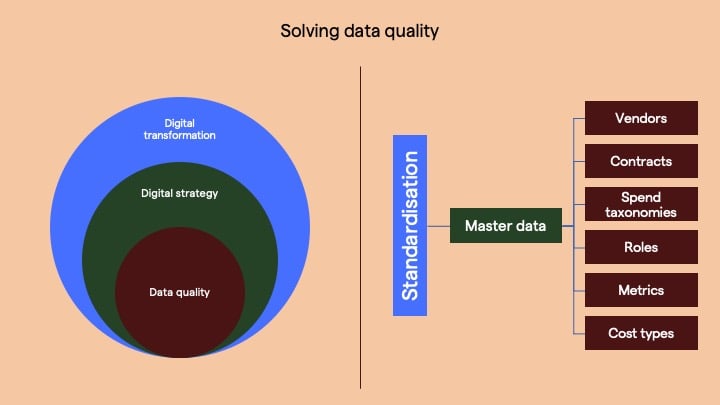

Zooming into quality of data, dirty data from multiple sources just create “bad fuel” for procurement analytics and workflows engines.

Deloitte also noted CPO’s willingness to solve this internal data complexity, which also ties in with the organisational complexity risk that CPOs have shown concern about apart from pandemic-related risks.

Proposed strategy:

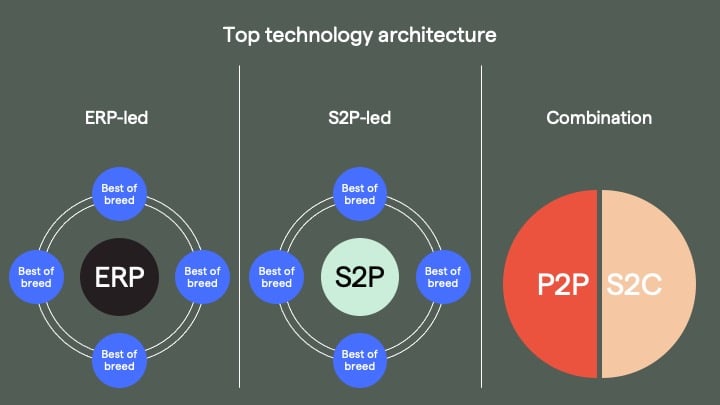

In terms of technology stack, for most organisations, a single system is not enough. The following shows the most common choice for procurement tech architecture.

Deloitte found that nearly 75% generally favour a “hub and spoke model”, where procurement teams embrace an ecosystem of solutions. The flip side of that is complexity risk, but for those who can overcome that, the reward is getting to value realisation fast.

Interestingly, investing in building their own tools wasn’t a popular choice, perhaps due to such a great risk involved.

Need help building a business case? Or unsure about what procurement solution you need? Check out the latest edition of our buyer's guide.

Get Procurement Software Buyer's Guide

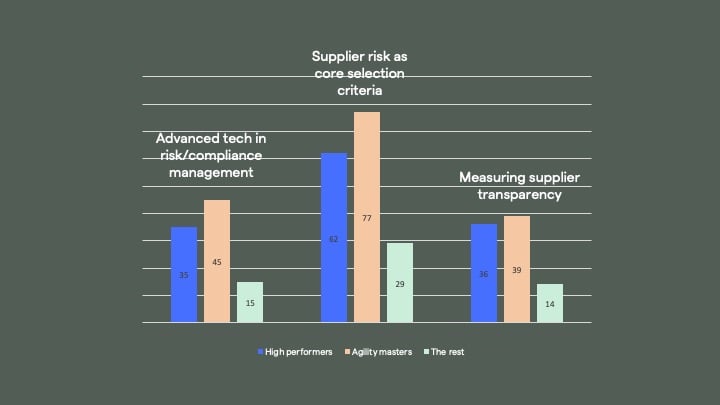

In comparing how different groups of organisations manage aspects of risk, Deloitte looked into the extent that High performers, Agility masters, and the rest:

- Adopt advanced tech in supplier/compliance management

- Have supplier risk as a core part of supplier selection criteria during sourcing

- Measure suppliers on transparency (e.g. business continuity planning and managing the next tier of suppliers)

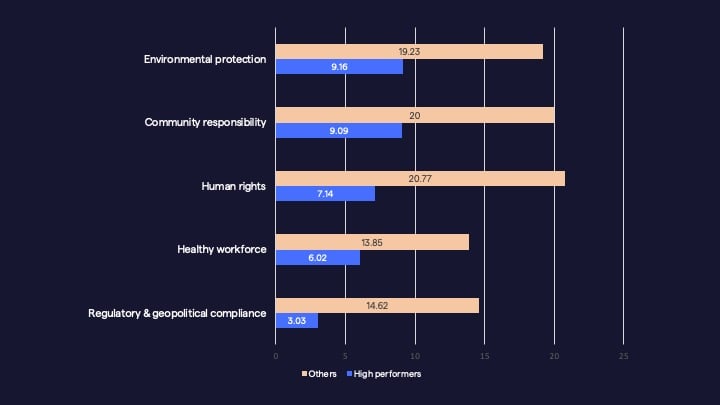

Prioritising CSR and ESG

These acronyms Corporate Social Responsibility (CSR) and Environmental, Social and Governance (ESG) have gained momentum in recent years, and often include supplier diversity metrics. However:

High-performing organisations prioritise CSR topics 13-44% higher than others, while also explicitly linking those CSR priorities to supplier engagement strategies.

Take a look at the CSR topics organisations say they are not addressing today, whether they have plans to address in the future or not.

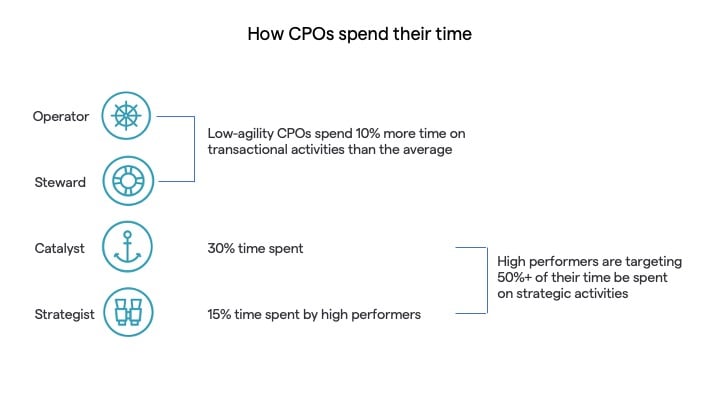

The evolving role of CPOs

Just like how CFOs have transcended their roles in the past (from “back- office accountant to the CEO’s right-hand lieutenant”), CPOs are also transforming their role.

Deloitte grouped these responsibilities into 4 archetypes:

- Operator (e.g. doing deals, saving money, managing contracts)

- Steward (e.g. assuring supply and compliance)

- Catalyst (ambitious and want to transition their organisations from middle or bottom tier to upper tier)

- Strategist (look to realise ambitions and contribute to business strategy)

Final words

The report ends by providing CPOs a to-do list to become agile. You can check out the 5-step plan in the full report.

If you’ve found the article useful, feel free to comment, share or subscribe to our blog for future insights.

Related Articles

Questions to ask when managing supply chain through COVID-19 and beyond

Whilst many countries and organisations are edging towards the next phase with recovery in mind, it might be a useful exercise to re-visit some questions that should have been asked a few weeks ago. And if they were asked, were there sufficient answers or solutions provided by technology?

Webinar recap: Why vendor management matters

Industry participants agreed that it’s not getting easier to source suitable third parties, according to the Building in The Dark report. In fact, 67% believed this process to be highly variable or very challenging.

Getting buy-in for procurement software: The Stakeholder playbook

Our previous post taking inspiration from the Ever Given saga, touched on some tips to build a business case for procurement software. No matter what job title you have, chances are you’ve already known you need a solution, now it’s just a matter of convincing others to share your vision.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.